Our core mission is to acquire undervalued alternative assets, add value and provide excellent returns and tax advantaged investment options to our partners.

We help passive investors discover new opportunities, stay safe from the volatility of Wall Street, while creating multiple streams of income. We believe in safe, clean affordable communities, building prosperity for our investors, residents and team.

IN MOBILE HOMES?

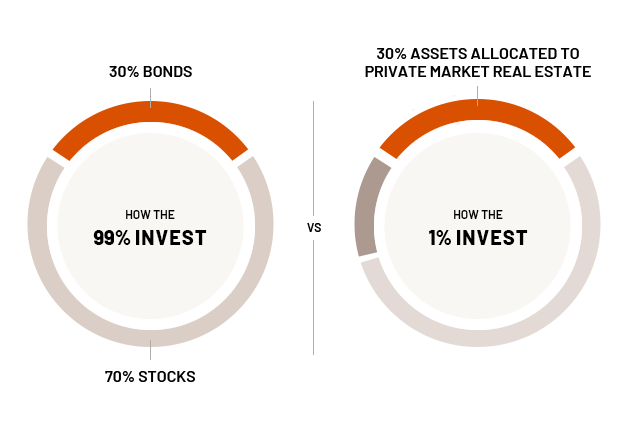

Mobile Home Parks are real estate, and so all of the reasons we love real estate (tax benefits, strategic leverage, hedge against inflation, and maybe most important: it’s NOT a Wall Street or a paper asset) are applicable here

There is no other way to put it. There is an incredible demand for affordable housing and mobile homes in particular. The unfortunate reality today is that according to the US Census Bureau, over 50% of Americans are living on less than $600 a week. And when it comes to retirement, over 75% of retirees have less than $30,000 in retirement accounts with a whopping 47% having NO savings whatsoever.

Why is Warren Buffet, through Berkshire Hathaway subsidiaries Clayton Homes and 21st Mortgage, one of the largest players in the mobile home space? For starters, the term mobile home is actually quite a misnomer. These homes rarely leave their parks due to the high cost of relocation: typically, around $5,000 and as much as $8,000 in some markets. Warren Buffet bets on value assets and is in it for the long term. PPC is honored to have partnered with Clayton Homes and 21st Mortgage and it has begun the process of ordering brand new mobile homes from Uncle Warren and tapping into the $8B (that’s billion with a ‘B’) of outstanding loans he has on mobile homes.

FOUR PEAKS CAPITAL PARTNERS

ACQUISITIONS

The Four Peaks Acquisition Team has over 30 years of experience identifying, analyzing, and negotiating Mobile Home Park investment opportunities. We foster direct relationships with owners in our target markets through years of boots-on-the-ground experience, direct mail campaigns, and other methods to keep our management team known to local and National Park owners.

ANALYSIS

Four Peaks conduct a detailed demographic analysis before investing in any market. Investments are evaluated with a near-term perspective on improving property performance and a long-term perspective on the health of the immediate and regional markets.

LEADERSHIP

The Four Peaks Team has years of experience in creating, building, and running multi-million-dollar investment platforms and organizations. The Team is actively involved on a day-to-day basis in every phase of operations, from acquisitions to active asset management.

TECHNOLOGY

We utilize advanced, proprietary technological tools to track each stage of the acquisition, repositioning/ improvements, and the overall asset-management process. Operational excellence is achieved through customized systems that allow us to closely monitor and manage a national portfolio of properties with local and regional area experts.

This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein.

THE OFFERING IS MADE ONLY BY THE PRIVATE PLACEMENT MEMORANDUM. THIS MATERIAL MUST BE READ IN CONJUNCTION WITH THE PRIVATE PLACEMENT MEMORANDUM IN ORDER TO UNDERSTAND FULLY ALL OF THE INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES ASSOCIATED WITH AN INVESTMENT IN THE SECURITIES TO WHICH IT RELATES AND MUST NOT BE RELIED UPON TO MAKE AN INVESTMENT DECISION.

The offering of securities described herein will not be registered under the Securities Act of 1933 (the “Securities Act”) or the securities laws of any state and the securities are being offered and sold in reliance on exemptions from the registration requirements of the Securities Act and such laws. Neither the Securities and Exchange Commission nor any other federal or state agency has passed upon the merits of or given their approval to the offering of the securities, the terms of the offering or the accuracy or completeness of the offering materials. The offering of securities is being made only to Accredited Investors, as defined in Rule 501(a) of Regulation D of the Securities Act. An investment in the securities is highly speculative and involves substantial investment and tax risks. All prospective investors must review the Private Placement Memorandum in its entirety, including the section entitled “RISK FACTORS” before investing.

An investment in Four Peaks Capital Partners, LLC is highly speculative and involves substantial risks, including, but not limited to: (1) Four Peaks Capital Partners, LLC success depends upon the performance of the Manager in managing Four Peaks Capital Partners, LLC and its investments, including decisions involving investment of Four Peaks Capital Partners, LLC’s capital and the acquisition and disposition of properties and there is no guarantee Four Peaks Capital Partners, LLC will raise enough capital to perform its investment objectives; (2) There can be no assurance that a prospective investor will receive any return on investment in Four Peaks Capital Partners, LLC and/or realize any profit on a prospective investor’s investment in Four Peaks Capital Partners, LLC and a prospective investor could lose all or a substantial portion of its investment; (3) The Manager has limited or no net worth and there can be no assurance that the Manager will have sufficient funds to meet its obligations to Four Peaks Capital Partners, LLC or to otherwise financially support Four Peaks Capital Partners, LLC; (4) The Class A members and Class B members have no power to take part in the management of Four Peaks Capital Partners, LLC and have limited voting rights and will not have the opportunity to evaluate or approve any of Four Peaks Capital Partners, LLC’s investments; (5) The Class A Interests and Class B Interests will be illiquid, and the transferability of the Class A Interests and the Class B Interests will be substantially restricted; (6) Four Peaks Capital Partners, LLC may not have the cash flow necessary to make distributions to its members; (7) Four Peaks Capital Partners, LLC will not diversify its investments and, therefore, the success of Four Peaks Capital Partners, LLC will be dependent upon the success of the properties; (8) There are substantial risks associated with real-estate investments and ownership of storage facilities and mobile home parks; (9) There are various potential conflicts of interest among the Manager and its Affiliates and their principals.

Investors must read and carefully consider the discussion set forth under the section entitled “RISK FACTORS” in the Private Placement Memorandum for a complete discussion of these and other risks pertaining to this investment.

These projections are speculative and based on specific assumptions, which, if incorrect, would cause the actual returns to differ materially from the projected returns. You should review the entirety of the assumptions and risks set forth in the Private Placement Memorandum.

Any underlying assumptions and any forward-looking statements herein may not be accurate, the projections herein shown may not occur, and actual results could differ materially due to risks and uncertainties that are beyond the Company’s ability to control or accurately predict. To the extent, the information in this communication conflicts with the information in the Private Placement Memorandum, the information in the Private Placement Memorandum shall govern.

The securities offered are an illiquid investment and involve a high degree of risk; Investors should be able to bear the loss of some or all of their investment. Investors should read and understand all of the risks and the entire Private Placement Memorandum before making a decision to invest. Past performance is no indication of future results and there can be no assurance that Four Peaks Capital Partners, LLC will be able to execute the investment objectives for the Properties or the Offering.

This material is for general information purposes only and does not constitute legal, tax, investment or other professional advice on any subject matter. Information provided is not all-inclusive and should not be relied upon as being all-inclusive.

Any capitalized terms used but not otherwise defined in this Presentation shall have the meanings set forth in the Private Placement Memorandum.

Any reference to “Four Peaks” “we” “our” or “fund,” regardless of capitalization, shall refer to Four Peaks Capital Partners, LLC, and its Affiliates.

For additional risks and disclaimers, visit https://fourpeakscapitalpartners.com

Four Peaks Capital Partners, LLC